Link Intime Allotment: A Comprehensive Guide

Introduction

Link Intime is a major player in the Indian market for IPO (Initial Public Offering) and corporate registry services. Understanding Link Intime allotment processes is crucial for investors participating in IPOs, rights issues, and other securities offerings managed by the company. This guide will delve deep into the intricacies of Link Intime allotment, offering you actionable insights and detailed explanations to navigate this essential aspect of investment management.

Link Intime Allotment

Link Intime allotment refers to the process through which securities are distributed to investors in IPOs, rights issues, or other offerings. This process is crucial as it determines your stake in a company post its public listing. The effectiveness and fairness of the Link Intime allotment process can significantly impact investor satisfaction and market perceptions.

The Role of Link Intime in IPOs

In the context of IPOs, Link Intime plays the critical role of a registrar. The company is responsible for collecting application data, handling the allotment process, and ensuring that shares are correctly distributed. The efficiency of Link Intime allotment during IPOs can greatly influence the initial trading days of a newly listed company.

How Does Link Intime Allotment Work?

The Link Intime allotment process involves several steps, beginning with the collection of applications to the final distribution of shares. Applicants can track their Link Intime allotment status online, which provides transparency and ease of access to important information regarding their investment.

Key Factors Influencing Link Intime Allotment

Several factors influence the Link Intime allotment process, including the number of applications received, the total shares offered, and regulatory guidelines. Understanding these factors can help investors better prepare for outcomes related to their Link Intime allotment results.

Steps to Check Link Intime Allotment Status

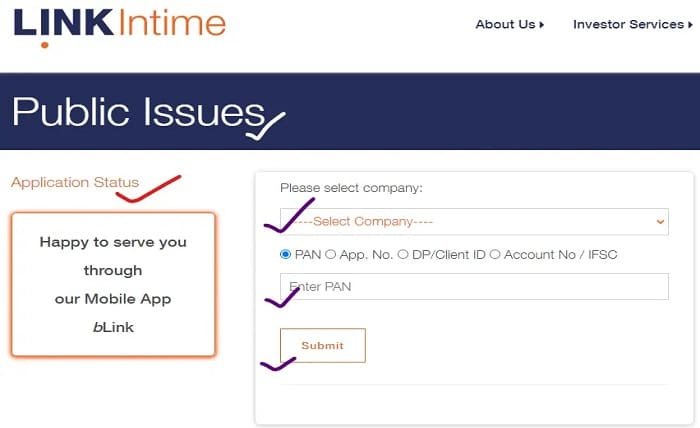

Checking your Link Intime allotment status is straightforward. Investors need to visit the official Link Intime website, select the IPO or issue from a dropdown menu, and enter their application number or PAN details. This section can guide you through each step, ensuring you know exactly how to access your Link Intime allotment information.

Link Intime Allotment for Retail Investors

Retail investors often wonder how Link Intime allotment prioritizes their applications. This part of the guide explains the specific considerations and quotas reserved for retail investors in the Link Intime allotment process, providing a clearer understanding of what retail investors can expect during IPOs.

Common Issues with Link Intime Allotment

While generally efficient, the Link Intime allotment process can encounter issues such as delays in allotment, server downtimes during high-demand periods, and errors in application processing. Addressing these common concerns can help investors manage their expectations and plan accordingly.

Tips for a Smooth Link Intime Allotment Experience

To ensure a smooth Link Intime allotment process, investors should follow best practices such as double-checking application details, applying early, and keeping abreast of IPO announcements and updates from Link Intime. This section offers practical tips to enhance your experience and success rate with Link Intime allotment.

The Impact of Technology on Link Intime Allotment

Technology plays a pivotal role in the efficiency and accuracy of the Link Intime allotment process. This part discusses how advancements in technology have shaped the way Link Intime manages allotments and what future improvements might look like.

Alternatives to Link Intime Allotment

For investors looking beyond traditional IPO allotments, this section explores alternative investment options that do not involve Link Intime allotment. Understanding these alternatives can provide broader investment strategies outside of standard equity offerings.

Link Intime Allotment in Corporate Actions

Beyond IPOs, Link Intime allotment is also involved in managing corporate actions like rights issues and dividend payments. This section details how Link Intime handles such scenarios, ensuring investors are well-informed about all aspects of Link Intime’s services.

Future Trends in Link Intime Allotment

Looking forward, the Link Intime allotment process is set to evolve with changes in market dynamics and technology. This section forecasts future trends in securities allotment and how Link Intime might adapt to these changes, helping investors stay ahead in a dynamic market environment.

Conclusion

Navigating through the Link Intime allotment process can seem daunting at first. However, with the right information and a clear understanding of the procedures, investors can manage their investments effectively. By keeping abreast of the latest updates and leveraging the insights provided in this guide, you can maximize your outcomes with Link Intime allotment.

Stay updated with the ajker gold rate and make informed buying or selling decisions. Gold prices fluctuate daily due to market demand, currency values, and global trends. Whether you’re investing in jewelry, coins, or bars, knowing today’s gold rate is crucial. Check our daily updates for accurate 22K, 21K, and 18K gold prices in Bangladesh. Factors like international markets, local taxes, and demand influence the gold rate today. Bookmark this page for real-time insights and expert tips on gold investments. Don’t miss out—track ajker gold rate and secure the best deals!

FAQs

1. What is Link Intime allotment?

Link Intime allotment is the process used by Link Intime, a key player in the Indian financial market, to distribute shares during IPOs and other offerings.

2. How can I check my Link Intime allotment status?

You can check your Link Intime allotment status by visiting their official website, selecting the relevant IPO, and entering your application number or PAN.

3. What factors affect Link Intime allotment?

Factors that affect Link Intime allotment include the number of applications, total shares offered, and adherence to regulatory guidelines.

4. What should I do if I encounter issues with my Link Intime allotment?

If you encounter issues with your Link Intime allotment, you should contact Link Intime’s customer support or consult the FAQs on their website for guidance.

5. Can technology impact my Link Intime allotment experience?

Yes, technology significantly impacts the Link Intime allotment process, enhancing efficiency and accuracy through automated systems and real-time updates.